QAS Pension Risk Transfer 1000 Index©

QAS PRT 1000 Index©

The QAS Pension Risk Transfer 1000 Index© is a proprietary index that was developed by Qualified Annuity Services, Inc. (“QAS”) over a period of more than seven years of research. Development of the QAS PRT 1000 Index© began prior to the adoption of the Pension Protection Act of 2006 (“PPA”).

Purpose of the QAS PRT 1000 Index©

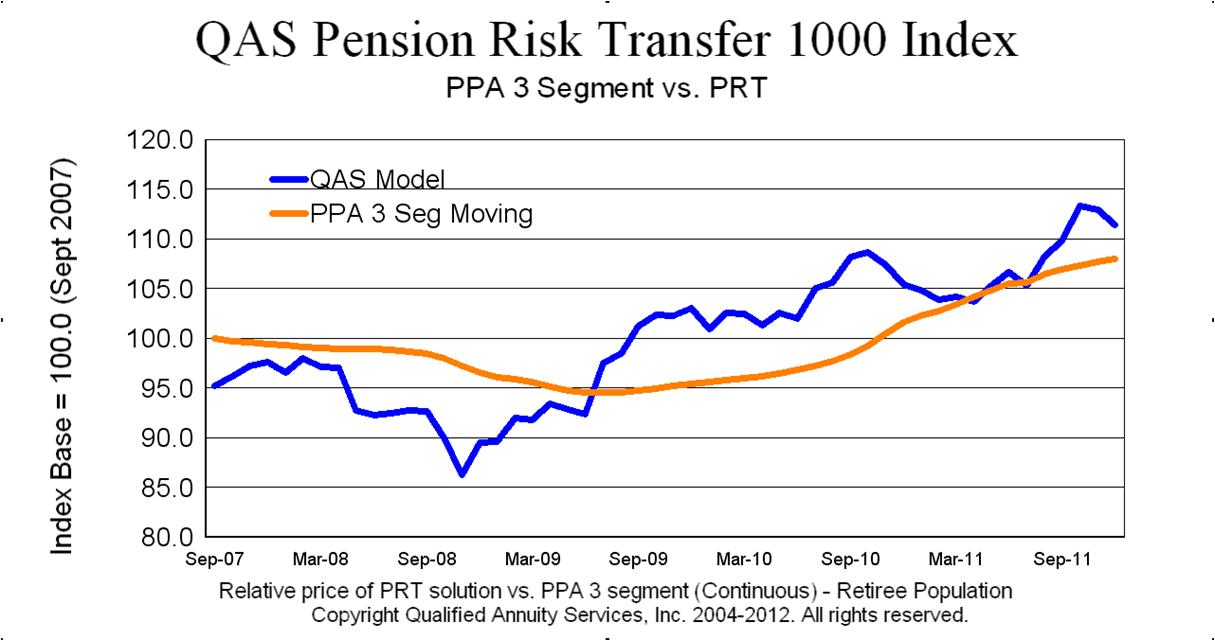

The PRT 1000 Index© tracks the monthly movement of a notional pension plan liability at PPA funding rates relative to Pension Risk Transfer (“PRT”) market rates maintained by QAS. The PRT 1000 Index© is designed to provide a reference for the “cost to fund” versus the “cost to transfer” part of DB liabilities under various scenarios. The QAS PRT 1000 Index© removes the “noise” and provides a view to the relative change in a notional Model Plan liability relative to various risk transfer solutions available within the market based solely upon changes in interest rates.

Construction of the QAS PRT 1000 Index©

The QAS PRT 1000 Index© was constructed from research on 1000 of the largest DB plans in the U. S. A Model Plan was populated based upon an analysis of present values from the largest 1000 DB plans. The Model Plan uses common base line assumptions as a starting point: RPA is the common mortality assumption and average RPA interest is the initial discounting rate. The Model Plan was then valued using PPA mortality and PPA 3-Segment rates as of September 1, 2007. The QAS PRT 1000 Index© is structured to have a beginning value of 100.0 as of September 1, 2007 which is the first applicable date for use of PPA 3-Segment rates. The PPA 3-Segment Index of 100.0 as of September 1, 2007 becomes the Index Base.

The QAS PRT 1000 Index© can function as a benchmark to compare and evaluate the relative impact of changes to PPA 3-Segment, PPA Curve, PRT and annuity risk transfer costs as well as for FAS accounting purposes. Customized views such as for Retirees only may be generated to model other risk or funding bench marks as needed by plan sponsors or actuarial consultants.

Profile of the QAS PRT 1000 Index© Model Plan

The QAS PRT 1000 Index© Model Plan population and associated PVAB’s is outlined in this table:

| Participant Category | Percent of Total Life Population | Percent of Total PVAB |

| Retirees | 22.3% | 38.8% |

| Term Vested | 30.6% | 18.8% |

| Active | 47.1% | 42.4% |

| Total | 100.0% | 100.0% |

The Model Plan Gender is summarized in this table for both per cent of population and PVAB:

| Participant Gender | Percent of Total Life Population | Percent of Total PVAB |

| Male | 59.2% | 69.2% |

| Female | 40.8% | 30.8% |

| Total | 100.0% | 100.0% |

The QAS PRT 1000 Index© Model Plan is valued using plan design parameters and experience assumptions for a typical DB plan. Among the key plan assumptions are:

| Normal Retirement Age: | 65 |

| Early Retirement Age: | 55 and 10 years of service |

| Early Retirement Factors: | 1/15th first 5 years; 1/30 next 5 years |

| Weighted Average Retirement Age: | 62.95 |

| Actuarial Equivalence: | Current liability mortality for 2007 |

| Interest: | 5.83% |

| Funding Method: | Unit credit |

Monitoring Risk Transfer Opportunities

The QAS PRT 1000 Index© provides a discrete view to risk transfer price without the potentially costly delays of an annuity bid process. Multiple PRT solutions and strategies can be monitored nearly in real time to assist in evaluating the possible impact upon savings and contributions. Plan sponsors can remain objective in their assessment of PRT solutions without endless proxy market bids. The QAS PRT 1000 Index© can be customized to a given DB plan and PRT strategy giving sponsors an eye to the market. PRT innovation continues to drive the market toward more attractively priced solutions which can be exhibited with the QAS PRT 1000 Index©